Achieve a faster, more accurate and controlled financial close. Download the BlackLine Solution Overview Brochure

Financial Close Management Overview

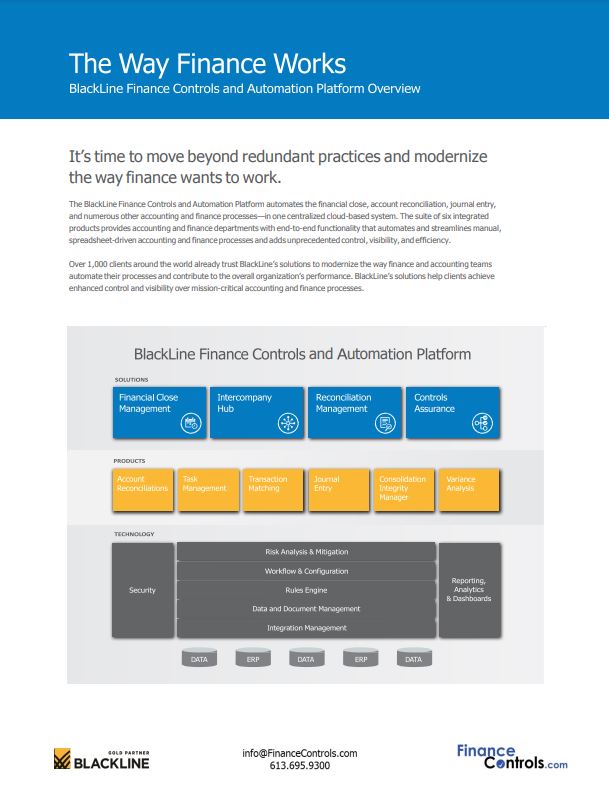

The BlackLine Financial Close Management solution empowers users to gain full control over the financial close process by streamlining accounting workflows, and producing financial and regulatory reporting in a timely manner, while ensuring accuracy and compliance auditability.

BlackLine products in the Financial Close Management solution include: Account Reconciliations, Task Management, Transaction Matching, Journal Entry, Variance Analysis, and Consolidation integrity Manager.

-

Account Reconciliations

BlackLine Account Reconciliations automates and standardizes the reconciliation process. It drives accuracy in the financial close by providing accountants with a streamlined method to verify the correctness and appropriateness of their balance sheets. The application provides an intuitive workspace in which accountants can quickly compare data (ERP, bank, subledger, schedules, etc.), investigate discrepancies, attach supporting documentation and take required actions.

Streamline the Reconciliation Process

BlackLine provides accountants with an intuitive interface for performing account reconciliations that includes standardized templates, workflows for review and approval, linkage to policies and procedures, and integrated storage of supporting documentation.

-

Task Management

BlackLine Task Management provides a configurable, web-based command center where you can manage accounting and finance tasks and processes. Utilizing a hierarchical task list, role-based workflow, and real-time dashboards, the task management product allows users to track and control a variety of task types. Unlock the potential of tasks with customizable templates for month-end close checklists, PBC lists, tax filings, and more.

Manage Accounting Tasks Accurately

BlackLine Task Management provides hierarchical task lists and workflows to control numerous manual processes across accounting and finance. It also includes task dependencies, certifications, and email notifications to ensure that each task is on track and deadlines are established, communicated, and achieved.

-

Transaction Matching

High-volume reconciliations can be some of the most time-consuming and painful components of the financial close process. The need to tick-and-tie millions of individual transactions can occupy hundreds of hours each month. BlackLine Transaction Matching streamlines and automates detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations and invoice-to-PO matching—all in one centralized workspace.

Enabling Transaction Accurately

Transaction Matching provides an effective and efficient way to identify matched and unmatched transactions, so accountants can focus on investigating discrepancies. Leverage the ability to match any type of data from multiple data sources, including external ERP systems, with flexible, rules-driven match sets.

-

Journal Entry

BlackLine Journal Entry provides a controlled, templated approach to centralizing journal entries. It is a complete journal entry management system that allows you to create, review, and approves journals, then electronically certify and store them with all supporting documentation. Journals can be posted to the general (or sub) ledger systems either on demand or in a batch on a schedule. Moreover, pre-posting validation means journals are not rejected from the general ledger due to entry errors.

Centralize & Automate Journals

Centralize all information concerning a given journal in one easily accessible place with comments, documents, and links to underlying matching transactions and reconciling items. Attach supporting documentation to journal entries electronically, reducing paper costs and lost work papers.

-

Variance Analysis

BlackLine Variance Analysis automates the tracking and analysis of account balance fluctuations. It provides enhanced controls through the identification of accounts whose balances fall outside of configurable thresholds so that these fluctuations can be properly investigated.

Move Beyond Spreadsheets

Much more dynamic than flat spreadsheets, the rules engine automatically creates variance analysis templates for accounts that deviate from defined parameters. Instantly identify unexpected fluctuation across target entities and across account groups, types, or ranges.

-

Consolidation Integrity Manager

BlackLine Consolidation Integrity Manager automates the tedious system-to-system reconciliation process companies perform each month. The process of comparing multiple ledgers to a consolidation system is replaced by an efficient, seamless workflow.

Streamline System Certifications

BlackLine Consolidation Integrity Manager automatically reconciles accounts where the balances tie out, meaning that end-users only have to worry about a fraction of the consolidation reconciliations each month and can dramatically shorten the time spent on this process.

Contact us

Phone: (613) 695-9300

Email: info@financecontrols.com

Address: 56 Sparks Street, Suite 502, Ottawa, ON K1P 5A9