Close Smarter

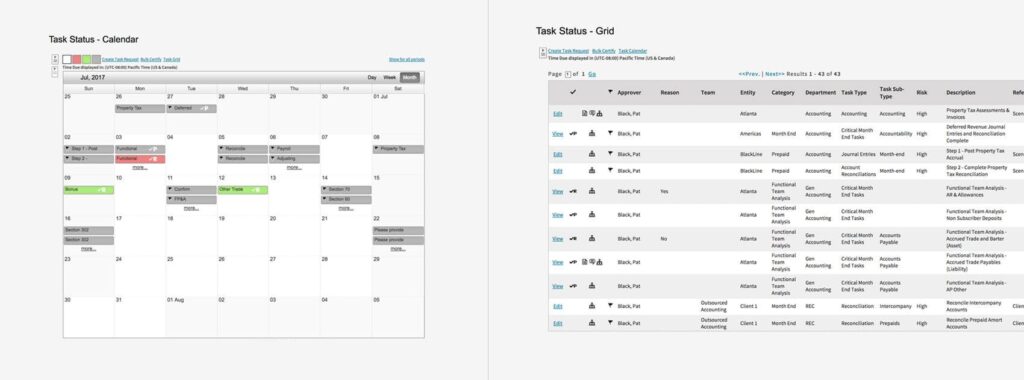

Centralize task management – from assignment to execution, review, and signoff – to provide a holistic view of operational performance and ensure compliance with various regulatory and reporting standards. Best practice workflows improve productivity and efficiency by reducing time-consuming, manual activities that deliver little to no value add, and automated internal controls help to mitigate risk while also streamlining your internal and external audit processes.

Strengthen Key Controls

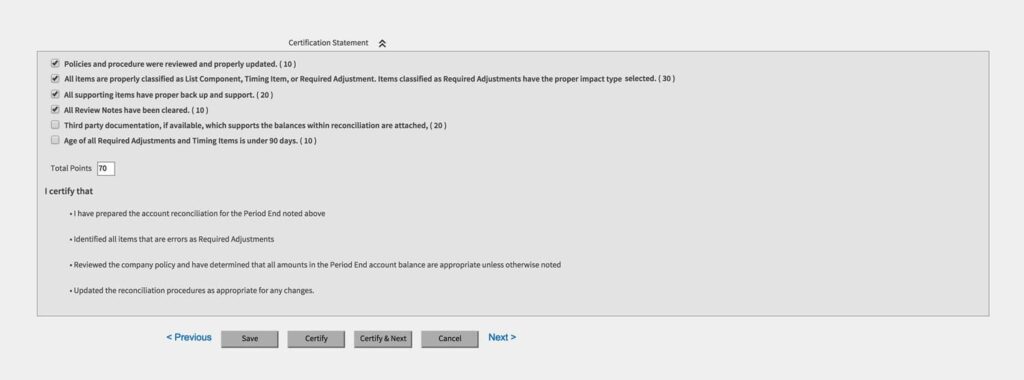

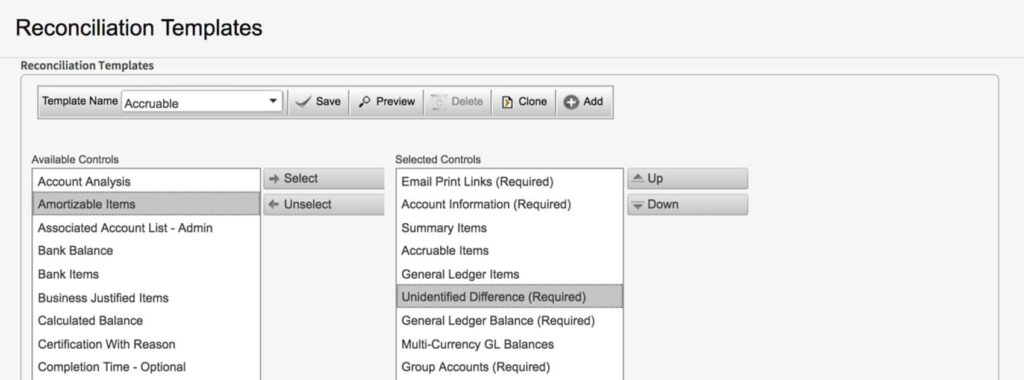

Embedded policies and procedures, certification checklists, automatic carry-over of aging and open items, role-based workflows, and electronic certifications enhance controls and accounting oversight, ensuring the proper delegation and sequence of tasks in adherence to internal and financial reporting guidelines. Moreover, global and cross-functional teams can easily collaborate and communicate in one place to quickly and effectively handle exceptions and analyze your real-time financial data.

Monitor Close Status

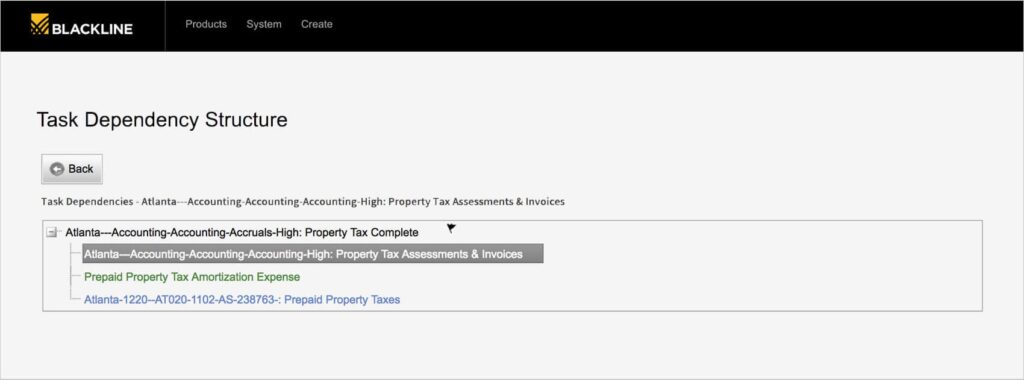

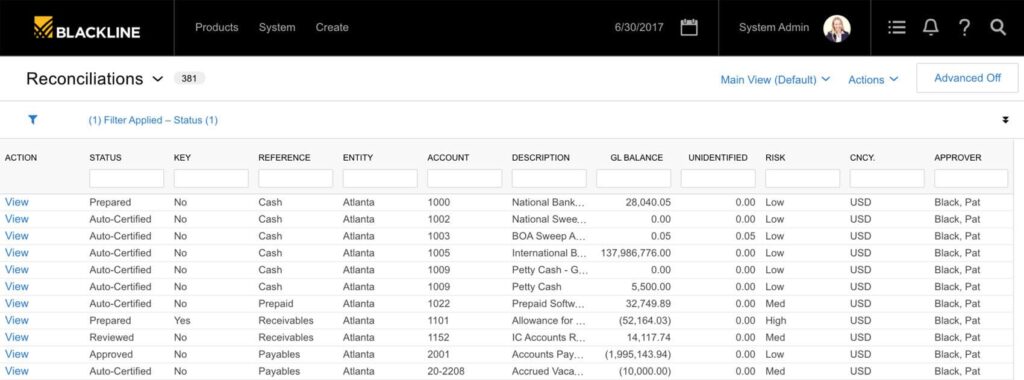

Whether your team is in one office or distributed around the globe, everyone – from staff accountants, to the Controller and CFO – has controlled access to track the progress of your close, across locations and entities, to gain a clear picture into the organization’s financial health at any given time. Cross-product task dependencies, real-time dashboards and enhanced reporting, in addition to email notifications, combine to improve accountability and ensure the timely resolution of discrepancies.

Ensure Financial Integrity

Centralize and validate data in a single place, and automate certification of certain accounts to free up time for your accountants to focus on ensuring the accuracy and completeness of financial results, rather than performing manual, tedious tasks. Tasks can also be linked to reconciliations to guarantee the correct sequence, flow, and rollup of related activities, while automated and standardized workflows ensure that every balance is fully substantiated.

Scale with Growth

As your organization continues to grow and evolve, either organically or through acquisition, BlackLine Close Process Management is fully extensible and easily conforms to meet the ever-increasing demands on the Accounting and Finance function from both internal stakeholders and external regulatory bodies. And by streamlining close operations, BlackLine enables teams to be more agile and responsive to changing business needs, even as complexity increases across the enterprise.

THE MODERN FINANCE PLATFORM

BlackLine is modernizing the finance and accounting function to enable greater productivity and better detection of accounting errors through Continuous Accounting. This new approach embeds automation, control, and period-end tasks directly within day-to-day activities, allowing the rigid accounting calendar to more closely mirror today’s dynamic business environments. As a result, companies can constantly monitor for error, fraud, and inefficiency before they become material misstatements.

BlackLine’s cloud-based solutions transform Finance & Accounting by automating, centralizing, and streamlining financial close operations, intercompany accounting processes, and other key F&A processes for large and midsize organizations across the globe. Designed to complement existing financial systems, BlackLine fills the gaps left by ERP and CPM systems to help companies increase operational efficiency, real-time visibility, and control and compliance. This ensures end-to-end financial close management and accounting automation, and drives better decision-making across the business.

Move beyond outdated accounting processes and point solutions, and empower your teams to work smarter and more efficiently. Accounting and finance departments in more than 2800 organizations around the world trust BlackLine to ensure accuracy in their accounting processes and the integrity of their financial statements. That’s more than 236,800 accountants, managers, controllers, auditors, and CFOs who rely on BlackLine to perform their mission-critical processes in near real time.

Contact us

Phone: (613) 695-9300

Email: info@financecontrols.com

Address: 56 Sparks Street, Suite 502, Ottawa, ON K1P 5A9