Overview: BlackLine Balance Sheet Integrity

Improve Efficiency and Eliminate Manual Processes

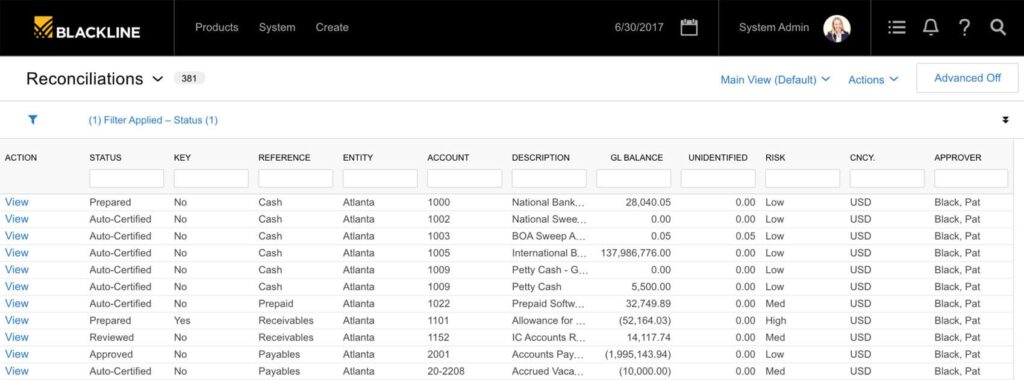

Increase efficiency across the close by systematically automating manual, repetitive, and non-value adding components of balance sheet account, bank, credit card, inventory, and other operational reconciliations. With automated data imports, rules-driven transaction matching, and customer-controlled auto-certification rules, companies using BlackLine automatically system-certify 45% of their reconciliations on average, with some achieving more than 70% system-certification to dramatically reduce period-end workloads.

Increase Accuracy

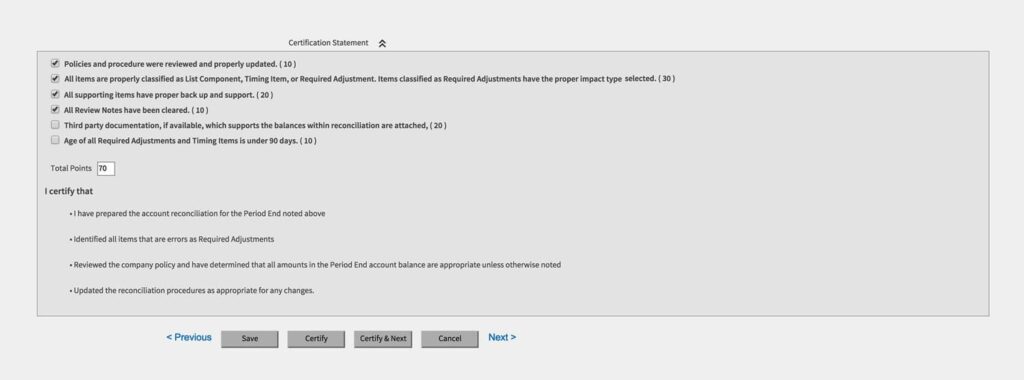

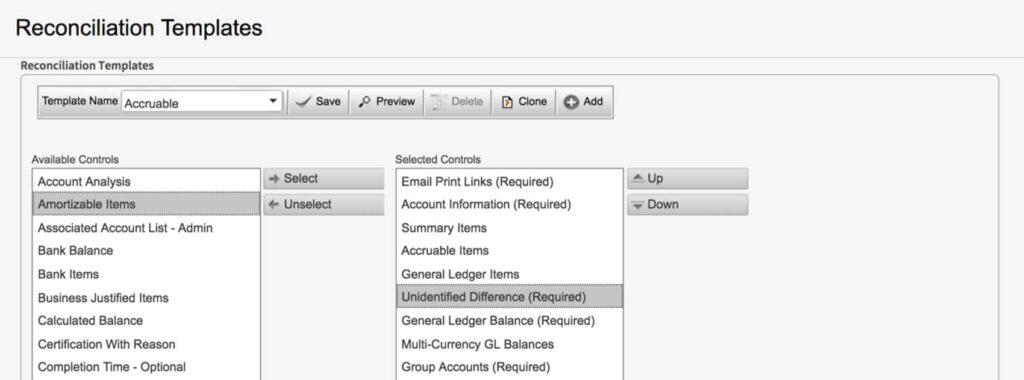

Standardized best practice reconciliation templates and configurable workflows help align processes to operational, financial reporting, and compliance objectives and create consistency in your operations, ensuring that the most up-to-date balances are being reconciled, unusual balances are quickly identified and addressed, and account preparers and reviewers adhere to overall reconciliation policies and procedures. As a result, accountants can focus on analysis, risk mitigation, and exception handling.

Minimize Risk with Proper Controls

Reduce the risk of financial discrepancies through embedded controls while creating transparency and accountability. BlackLine Balance Sheet Integrity enables accounting leaders to maintain proper segregation of duties among accounting team members, provide auditors easy access to review reconciliations, and configure risk rules to quickly identify irregular activity. Each step in the period-end process is tracked with a full audit trail, and every account is fully substantiated.

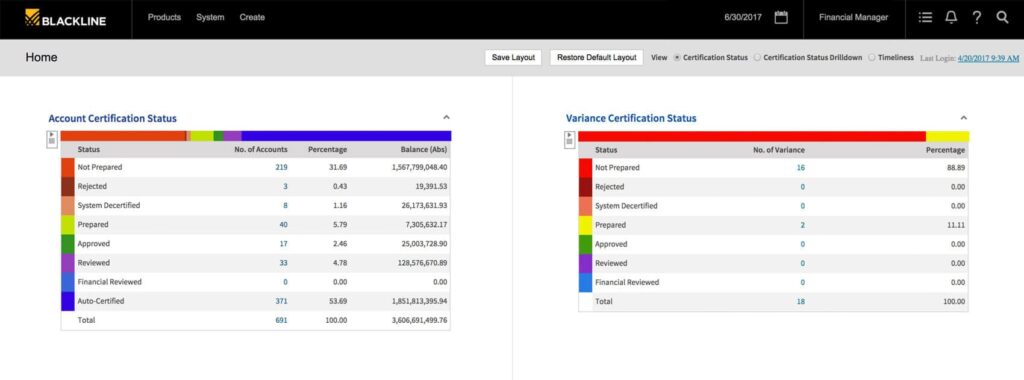

Maximize Visibility

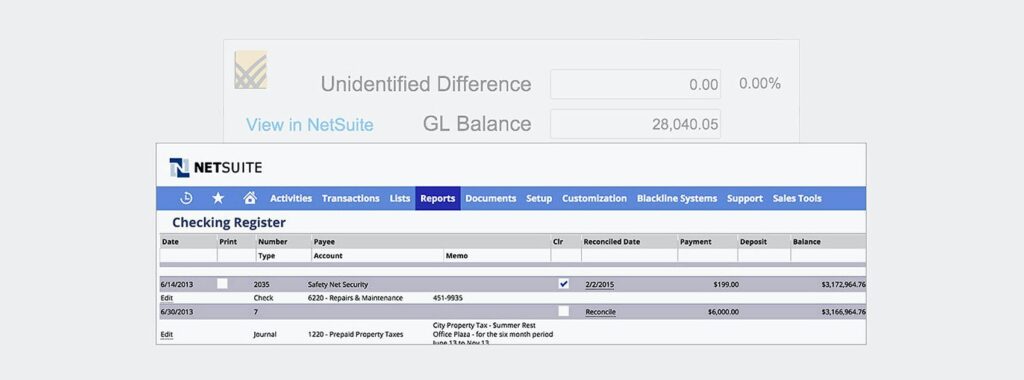

Drill down into pertinent supporting information directly within BlackLine. You can dive right into your ERP account details, review matched and unmatched transactions, and access management reports, dashboards, and real-time information to analyze accounting data, surface new intelligence, and measure performance against established metrics. Create a secure and controlled global view into the status of your reconciliations, and ditch the paper to gain full visibility into your end-to-end process.

Ensure System Interoperability

Whether you’re on a single ERP or have many disparate, disconnected financial systems, BlackLine is ERP-agnostic and integrates with your technology investments to deliver a complete reconciliation management solution. And because our solution is built on a single codebase, rather than a patchwork of cobbled together technologies acquired over time, our products work together on a private cloud platform, seamlessly and securely sharing datasets and workflows with your organization’s systems.

“When I think about BlackLine, seamless, transparent, greater visibility, and increased control are all words that come to mind.”

Eamonn Matthews, Business Process Lead – Accounting & Reporting, The Coca-Cola Company

THE MODERN FINANCE PLATFORM

BlackLine is modernizing the finance and accounting function to enable greater productivity and better detection of accounting errors through Continuous Accounting. This new approach embeds automation, control, and period-end tasks directly within day-to-day activities, allowing the rigid accounting calendar to more closely mirror today’s dynamic business environments. As a result, companies can constantly monitor for error, fraud, and inefficiency before they become material misstatements.

BlackLine’s cloud-based solutions transform Finance & Accounting by automating, centralizing, and streamlining financial close operations, intercompany accounting processes, and other key F&A processes for large and midsize organizations across the globe. Designed to complement existing financial systems, BlackLine fills the gaps left by ERP and CPM systems to help companies increase operational efficiency, real-time visibility, and control and compliance. This ensures end-to-end financial close management and accounting automation, and drives better decision-making across the business.

Move beyond outdated accounting processes and point solutions, and empower your teams to work smarter and more efficiently. Accounting and finance departments in more than 2800 organizations around the world trust BlackLine to ensure accuracy in their accounting processes and the integrity of their financial statements. That’s more than 236,800 accountants, managers, controllers, auditors, and CFOs who rely on BlackLine to perform their mission-critical processes in near real time.

Contact us

Phone: (613) 695-9300

Email: info@financecontrols.com

Address: 56 Sparks Street, Suite 502, Ottawa, ON K1P 5A9