Optimize Efficiency

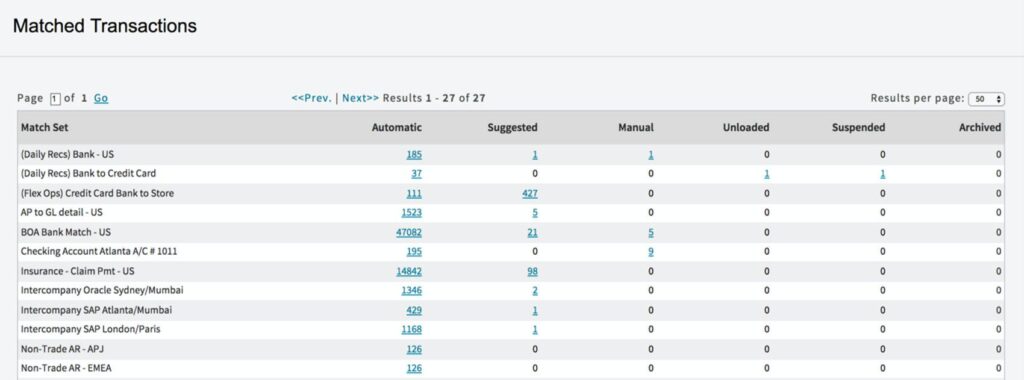

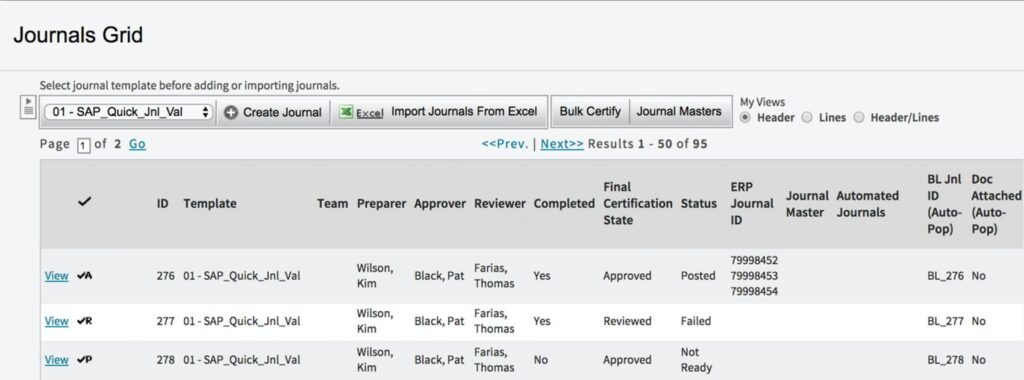

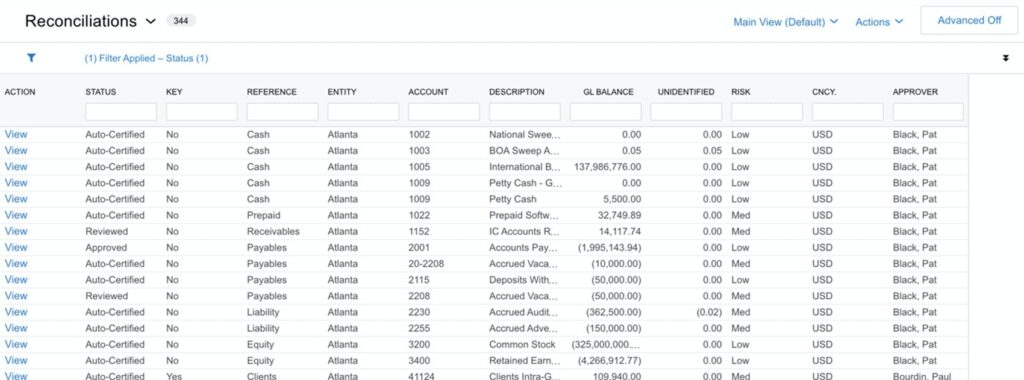

Automate routine, high-volume tasks that are prone to human error and consume valuable staff resources. Standardized reconciliation templates combined with configurable certification and matching rules enable a best practice approach to automate the validation of low-risk accounts, creation of reconciling items from unmatched transactions, and posting of journal entries, freeing your accountants to focus on exception handling and deep analysis.

Increase Accuracy

Automatically import and centralize transactional data from multiple source systems and impart intelligent automation rules to create a structured and consistent approach to managing and handling your most onerous accounting tasks. By applying pre-posting validation to journals and automatically matching transactions across business applications, error-prone, manual processes are effectively eliminated to improve the speed and accuracy of your accounting workflows.

Enhance Internal Controls

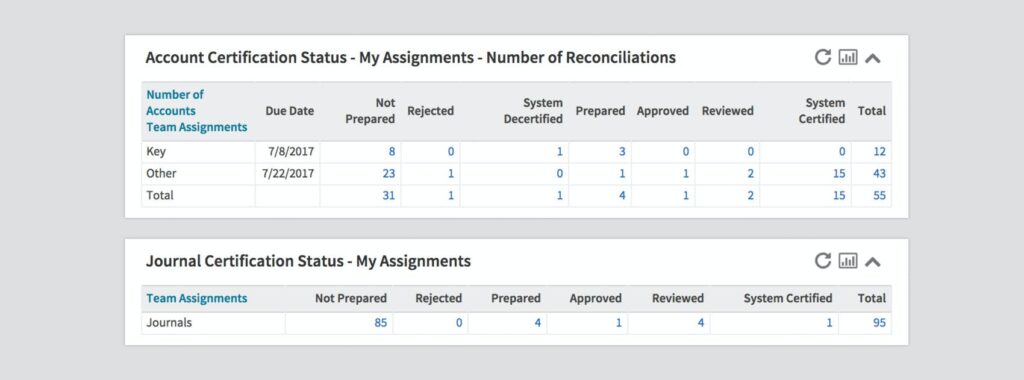

Controlled roles-based access, coupled with configurable approval and certification workflows, supports strong operational governance and delivers full auditability across your standardized and streamlined finance processes to reduce the risk of control failure and misstatement. And because automated processes are continuously monitored, teams are quickly alerted to any deficiencies and discrepancies, ensuring ongoing regulatory compliance.

Drive Continuous Improvement

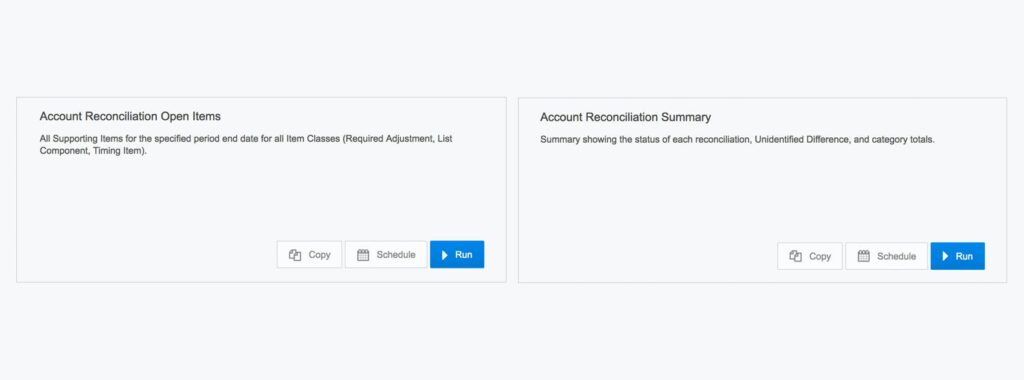

Real-time configurable reports and dashboards provide an accurate and complete view into financial data and results, allowing teams to continuously monitor the quality and efficiency of accounting and finance operations. And by leveraging additional export capabilities, pivot tables, and dashboard visualizations, staff can drill into valuable data to identify opportunities for further process improvement. Modifications can be tested thoroughly in a mirrored production environment to effectively assess the impact of changes to deliver proven value to the organization.

Improve Productivity

By applying automation to repetitive, manual, and time-intensive processes, teams are relieved of the mundane tasks that lower engagement and inhibit their ability to focus on creating value and improving accounting service delivery. And with more time for analysis, accounting and finance can hone their skills and become more agile to meet the changing needs of the business in the face of increasing demands and complexity – now and into the future.

THE MODERN FINANCE PLATFORM

BlackLine is modernizing the finance and accounting function to enable greater productivity and better detection of accounting errors through Continuous Accounting. This new approach embeds automation, control, and period-end tasks directly within day-to-day activities, allowing the rigid accounting calendar to more closely mirror today’s dynamic business environments. As a result, companies can constantly monitor for error, fraud, and inefficiency before they become material misstatements.

BlackLine’s cloud-based solutions transform Finance & Accounting by automating, centralizing, and streamlining financial close operations, intercompany accounting processes, and other key F&A processes for large and midsize organizations across the globe. Designed to complement existing financial systems, BlackLine fills the gaps left by ERP and CPM systems to help companies increase operational efficiency, real-time visibility, and control and compliance. This ensures end-to-end financial close management and accounting automation, and drives better decision-making across the business.

Move beyond outdated accounting processes and point solutions, and empower your teams to work smarter and more efficiently. Accounting and finance departments in more than 2800 organizations around the world trust BlackLine to ensure accuracy in their accounting processes and the integrity of their financial statements. That’s more than 236,800 accountants, managers, controllers, auditors, and CFOs who rely on BlackLine to perform their mission-critical processes in near real time.

Contact us

Phone: (613) 695-9300

Email: info@financecontrols.com

Address: 56 Sparks Street, Suite 502, Ottawa, ON K1P 5A9